The domestic market is breaking through internal competition, foreign tariffs are rising again, and emerging markets for fasteners are on the rise

01

Policy hits hard to break through 'internal competition'

In June of this year, the "Regulations on Ensuring Payment for Small and Medium sized Enterprises" were enforced, putting an end to the 180 day payment term hegemony of car companies.

17 car companies including BYD, NIO, Xiaomi, Xiaopeng, Chery, Leapmotor, and Ideal have collectively committed to "payment terms not exceeding 60 days", directly releasing billions of dollars in cash flow, significantly easing the capital turnover pressure of automotive fastener manufacturers.

At the same time, in July, the Central Committee of Finance and Economics and the Political Bureau successively held meetings to deepen the construction of a unified national market, regulate disorderly competition among enterprises in accordance with laws and regulations, and promote capacity management in key industries. Subsequently, industries such as photovoltaics, steel, and cement responded to the call.

Major domestic photovoltaic glass enterprises plan to collectively reduce production by 30%.

The China Cement Association has released work opinions, stating that cement companies in many regions have staggered production or suspended production and limited production according to market supply and demand and environmental protection requirements.

The phenomenon of production reduction in the steel industry is also quite prominent, and some steel companies have received internal notices that there has been a significant increase in shutdown and maintenance activities.

Previously, the China Association of Automobile Manufacturers and the All China Federation of Industry and Commerce Automobile Dealers Association successively issued initiatives calling on the entire industry to resist "inward competition". The China Battery Industry Association and the China Plastics Processing Industry Association have jointly released an initiative to promote the healthy development of the battery industry chain, calling for industry competition to shift towards "quality and innovation competition".

This policy combination has seized a time window for the fastener industry to transform and upgrade.

02

The tariff war is making waves again

The situation is not very good.

The tariff agreement expires in August, and the United States has once again sparked a tariff storm. According to the latest negotiation results, the United States has adjusted tariffs in various regions as follows:

The tax rate for Japan and South Korea is 15%;

Canadian tariffs have been raised from 25% to 35%;

Syria has the highest "equivalent tariff" rate, set at 41%;

The tax rate in Myanmar and Laos is set at 40%;

Brazil and the UK have the lowest tariffs, set at 10%;

India imposes a 25% tariff and implements additional punitive measures;

The tariff rate in Vietnam is set at 20%;

The tariff rate in most countries and regions is set at 15%;

The tax rate in Taiwan has been adjusted to 20% on the surface, but in reality, it is "adding temporary equivalent tariff rates on the basis of the original most favored nation tariff." The industries that have been hardest hit include machine tools, molds, plastic products, and electronic components. As the world's third-largest producer of metal fasteners and the majority of which are sold to the United States, Taiwan will be the first to see screw and other fastener manufacturers.

The outcome of the negotiations between the United States and the European Union regarding this adjustment is worthy of our attention. In addition to tariffs, the US-EU agreement also has three main points:

The United States will impose a 15% tariff on most EU goods, and Europe will open its market to the United States.

The EU will increase its investment in the United States by $600 billion on the basis of existing investments.

The EU purchases $750 billion worth of American energy products and billions of dollars worth of American military equipment.

Moreover, the steel and aluminum tariffs that the EU attaches the most importance to have not been resolved in this agreement. US officials said that this agreement does not involve EU steel and aluminum tariffs, which means that steel and aluminum tariffs do not enjoy a 15% tax rate and remain at 50%.

It can be seen that even if this agreement is only implemented at 60%, EU companies will face severe challenges. This indicates that after joining the customs union, the EU will be incorporated into a new economic order centered on benefiting the United States, and its position as an independent economy will be weakened.

The billions of dollars in the agreement will ultimately be shared among member countries' enterprises. Currently, European companies have experienced large-scale shutdowns and industrial outflows due to a sharp increase in production. In this context, enterprises that undertake new obligations are likely to further ignite a wave of investment and industrial transfer to the United States.

No matter how the tariff target is ultimately achieved, the EU is likely to seek compensation in other areas and may not rule out further increases in tariffs on Chinese goods. If trade remedy measures such as anti-dumping and anti subsidy are added, Chinese goods will face greater pressure in the international market, and the export situation may further deteriorate.

Compared to the EU's compromise with the United States, China has made significant progress in the third round of negotiations with the United States

Yesterday, the Stockholm Economic and Trade Talks between China and the United States jointly issued the latest statement, extending the suspension of tariffs originally scheduled to expire on August 12, 2025 for 90 days.

According to the consensus reached during the talks, both China and the United States will continue to maintain the current tariff level unchanged

US tariffs on Chinese goods: 10% (reserved portion)+24% (suspended portion)=actual implementation of 10%

China's tariffs on US goods: 10% (reserved portion)+24% (suspended portion)=actual implementation of 10%

This means that Chinese fastener companies will continue to enjoy relatively low tariffs in the United States during the next three-month window period.

03

新兴市场崛起

现今,面对美国在利益谈判桌上步步紧逼时,我国已经可以凭实力寸土必争,毫不妥协。

美国依然是全球最大市场,但多方新兴市场崛起,我们可以逐渐降低对美国市场的依赖。

例如提出“进口替代2.0”政策和基建投资计划的俄罗斯,今年4月会议中提到2030年前完成6.63亿平方米住房建设,拟投入4.5万亿卢布更新公共事业系统,道路修补节奏不能放缓等多项基础设施建设计划。

有大量基建需求的中东市场同样受重点关注。

7月,沙特NEOM未来城的最新建设动态引来业内测算,有人称未来五年NEOM建设或将拉动超万亿美元级别的建材需求,其中约40%-45%有望通过国际招标渠道完成。

而伊拉克更是早在2018年已发布《战后重建评估报告》。里面指出,战后重建的资金需求高达880亿美元,其中包括水电、交通、卫生等多个领域。今年以来,伊拉克从能源开发到交通基础设施,再到工业原材料领域,多个重点项目正在推进,为我国企业提供广阔的合作空间。

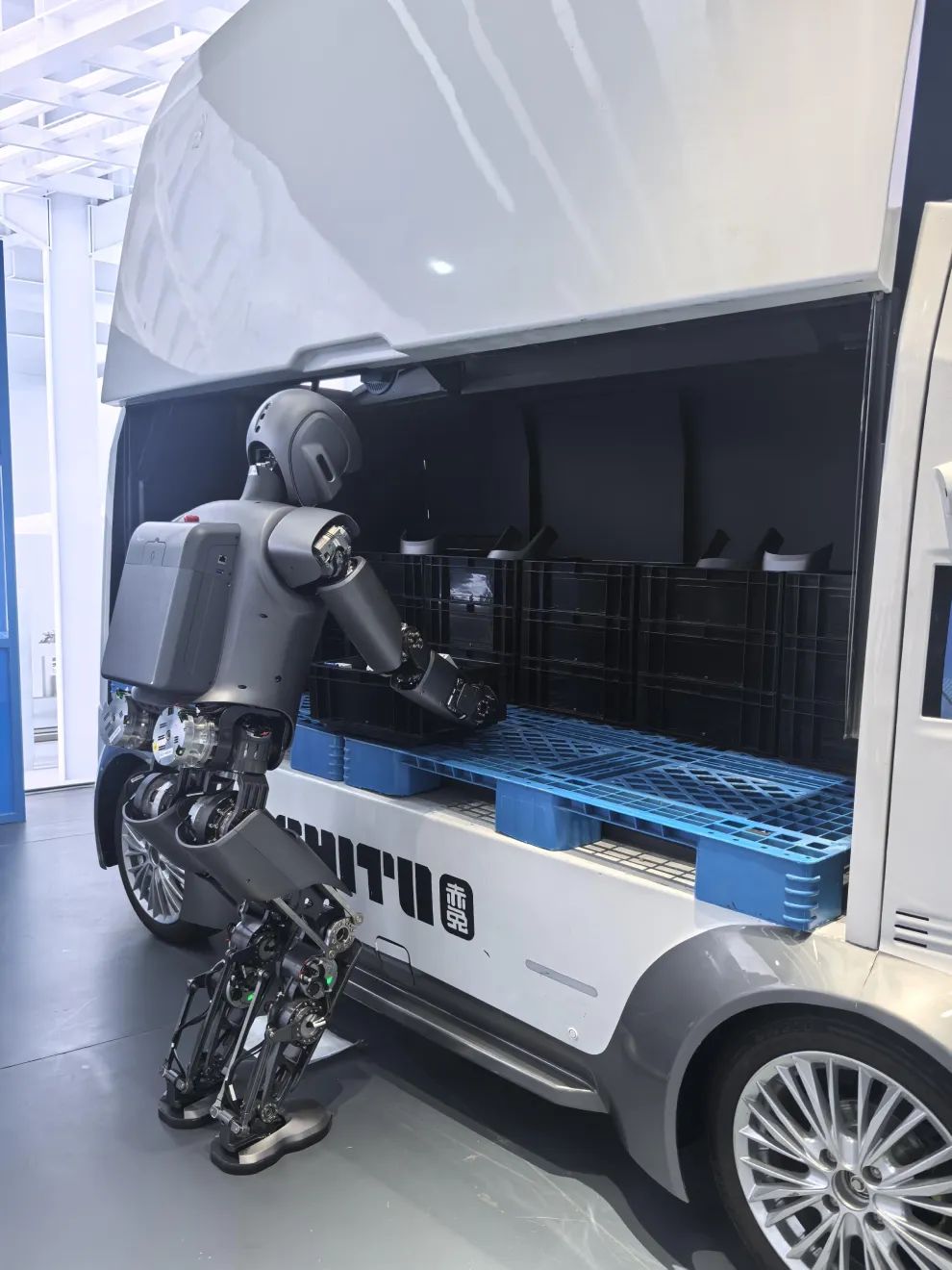

除了国外的机会,国内新兴产业也呈现出蓬勃发展的良好势头。人形机器人与低空飞行汽车迎来订单潮,多家企业表示量产在即。

人形机器人方面——

今年7月,松延动力成功量产并交付了105台人形机器人,创公司成立以来的单月量产及交付新高。

在近期落幕的世界人工智能大会上,银河通用公司高管表示商超值守机器人已获100家门店订单。

旗下有AlphaBot(爱宝)系列的智平方透露,今年已收到近500个通用智能机器人订单,主要用于工业及公共服务。

优必选的工业人形机器人WalkerS正加速进入工厂生产线,合作名单有吉利、比亚迪、富士康等知名企业,企业以交付量千台为目标。

智元机器人规划今年实现数千台人形机器人的出货量,目前,其线下量产机器人数量已突破2000台。据6月份中国移动采购与招标网公示的信息,智元机器人和宇树科技还拿下了杭州中移超1.2亿元的人形机器人订单。

宇树科技虽未透露今年具体的订单数,但创始人王兴兴在2025世界机器人大会WRC期间演讲中称,公司旗下的G1人形机器人有望成为今年全球出货量最高的型号,新款人形机器人R1正处于量产推进阶段。

低空飞行汽车方面——

7月,上海时的科技获得阿联酋Autocraft公司350架E20 eVTOL订单,订单10亿美元,折合人民币约71亿元。

小鹏汇天广州飞行汽车工厂封顶,计划2026年量产交付其双座飞行汽车“陆地航母”,此前已获超4000台预订。

6月,广汽高域量产型GOVY AirCab(多旋翼飞行汽车)全球首发,当场收获上千意向订单,于7月顺利交付样机。

江苏金租与零重力飞机工业达成战略合作,签署150架航空器采购意向协议。

5月,沃飞长空与中国银行四川省分行、中银金租达成合作,三方共同签署120架AE200机型意向采购订单,公司称目前已斩获数百架eVTOL订单。

沃兰特也与中银金融租赁有限公司、中国银行上海市闵行、长宁支行签署协议,中银金租拟向沃兰特采购100架VE25型eVTOL。据悉沃兰特VE25-100型eVTOL已获得近千架意向订单。

峰飞航空和中信海直、中信金租签约,包含中信金租100架大型eVTOL意向订单,并获汉阳投资12架eVTOL订单,总金额1.57亿元。

行业龙头亿航智能的EH216-S已量产交付,2024年交付216架,公司负责人今年3月表示,在手意向订单超1000架,另有多笔在谈。

04

Refactoring competitiveness

The spring breeze of anti involution will eventually blow to the fastener industry, breaking the vicious cycle of "low price for market".

Although the tariff storm increases risks for the future situation of the foreign trade market, opportunities also exist.

Actively learn and apply new technologies such as artificial intelligence, explore new overseas markets such as Russia and Iraq, and actively seek opportunities for fastener companies to transform and upgrade in emerging industries such as low altitude flying cars and humanoid robots.

By constantly facing the changes of the times and technology, actively embracing them, and aligning with the direction of development, enterprises can reconstruct their competitiveness in the disconnected foreign trade environment.

Now is a great opportunity to enter the Russian market!

To help Chinese enterprises deeply explore the Russian fastener market, we have launched a special training program for the Russian market in 2025.

The itinerary is scheduled for November 10-17 (7 nights on the 8th), and will gather decision-makers, technical experts, and foreign trade elites from domestic fastener companies to conduct on-site inspections of the Russian industrial ecology.

The training program focuses on in-depth participation in the 2025 Russian International Hardware Tools and Fasteners Exhibition (MITEX) held from November 11-14.

In response to the demand of the Russian fastener industry, this exhibition has set up a fastener section, where 50% of participating companies will be local fastener manufacturers in Russia, and will be presented in large special booths.

If you participate in the exhibition, you will exhibit together with Russian fastener companies to form a specialized display in a segmented field.

Whether you want to participate in exhibitions or visit, you can form a group.

Contact us, you may also have the opportunity to negotiate face-to-face with giants such as Russian Railways and Gazprom, and seize the trillion dollar market of the Arctic Energy Corridor and the upgrade of the Siberian Railway!

Please first Loginlater ~